Pakistan Cryptocurrency Regulation: 2025

Pakistan cryptocurrency regulation is entering a new era in 2025, as the government pushes forward with an official framework to legalize and mainstream digital currencies like Bitcoin and Ethereum. This move marks a historic shift from previous uncertainty, aiming to align Pakistan with global trends in financial technology. The new regulatory approach is expected to enhance transparency, attract foreign investment, and provide a secure environment for blockchain-based innovation. By formally recognizing crypto assets, Pakistan hopes to unlock new avenues for digital finance, improve remittance channels, and encourage youth participation in the global digital economy.Pakistan cryptocurrency regulation is entering a transformative phase in 2025, as the government unveils legal measures to legitimize and mainstream digital assets like Bitcoin and Ethereum.

The Pakistan cryptocurrency regulation push is part of a broader strategy by the government to strengthen digital infrastructure, modernize financial systems, and attract investment in blockchain technologies. Unlike previous uncertain approaches, this new direction is both official and ambitious.

Why Pakistan Is Fast-Tracking Crypto Legalization

With remittances topping $30 billion annually, a significant portion of Pakistan’s foreign income comes from its diaspora. Traditional remittance channels are often slow and expensive, involving high fees and long delays. Cryptocurrency provides a compelling alternative—fast, secure, and cost-effective.

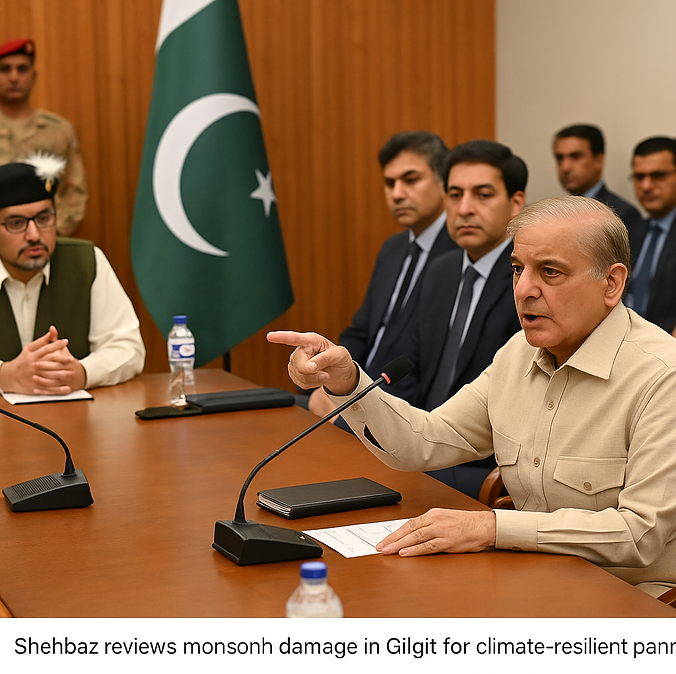

According to a Coindesk report, Pakistan’s Ministry of IT and Finance is working with the State Bank of Pakistan (SBP) to develop a legal framework that allows crypto transactions for remittances, e-commerce, and investment under AML (Anti-Money Laundering) compliance.

Key Sectors Affected by Crypto Regulation

The formalization of Pakistan cryptocurrency regulation is expected to impact the following sectors:

| Sector | Impact of Regulation |

|---|---|

| Remittances | Faster, cheaper global money transfers |

| Forex Management | Greater control and diversification of reserves |

| Banking | Introduction of crypto-linked accounts and wallets |

| Fintech Startups | Regulatory clarity boosts innovation and foreign investment |

| E-Commerce | Crypto integration as a legitimate payment option |

This structural shift could also reduce reliance on informal hawala systems and increase accountability across the financial ecosystem.

How Individuals & Businesses Will Benefit

For ordinary citizens—especially overseas Pakistanis—this change promises a more streamlined process to send money home. No longer bound by third-party remittance providers, users will be able to utilize government-approved crypto exchanges for instant fund transfers.

For Pakistani entrepreneurs and developers, the opportunity is even greater. With a regulatory green light, startups can now build blockchain apps, crypto payment solutions, and decentralized platforms without fear of legal repercussions. This is expected to boost innovation, job creation, and even foreign direct investment (FDI) in the fintech space.

Moreover, Pakistan’s large unbanked population could find new access to financial services through mobile crypto wallets and blockchain-based credit systems.

Policy Challenges and Road Ahead

Despite the enthusiasm, Pakistan’s crypto future is not without hurdles. Experts warn of the following risks:

- Cybersecurity vulnerabilities

- Limited public awareness about crypto use

- Regulatory gaps in enforcement and taxation

- Potential misuse of digital currencies for illicit activities

However, the government has stated it will implement robust KYC (Know Your Customer) and AML frameworks to ensure user protection and international compliance.

A phased rollout is expected, beginning with regulated remittance channels, followed by licensed exchanges and crypto banking features later in 2025.

Internal & External Resources

Internal Link Suggestion:

Link to: “How Blockchain Is Transforming Asian Economies” on Writozy.

External Link Suggestion:

Read more at: Coindesk – Pakistan to Regulate Crypto Trade

Conclusion: A Digital Leap Forward

The launch of Pakistan cryptocurrency regulation marks a historic shift in the country’s approach to digital finance. With strategic reforms targeting remittances, fintech development, and e-commerce, Pakistan is signaling its readiness to participate in the global crypto economy.

If implemented wisely, these steps could place Pakistan among the leading digital finance hubs in South Asia—fostering innovation, expanding financial inclusion, and strengthening economic resilience.

Related ; Writozy